On the evening of April 21, Sichuan Changhong (600839.SH) released its 2020 annual report. The company's revenue last year increased by 6.37% to 94.45 billion yuan, but only earned a profit of 0.45 billion yuan, and its net profit has declined for 4 consecutive years. The overall operating loss of the color TV business. Regarding performance, Sichuan Changhong explained it in its annual report as being affected by factors such as the spread of the new crown epidemic, the downturn of the macro economy, and changes in terminal consumer behavior.

Cao Wuque flipped through the financial reports of the previous few years: This rhetoric is a bit familiar?

In 2019, Changhong’s financial report attributed the decline in electrical appliance revenue to “affected by factors such as the macroeconomic downturn, demographic and consumer behavior changes, and changes in the industry competition pattern. The overall growth rate of the home appliance industry has slowed down”. When it comes to the epidemic, otherwise Ctrl C+V will not be easy to pass the duplicate check.

The current situation of Changhong cannot be said to be related to the general environment of home appliances, but it is also in the field of home appliances. "Friends" Hisense, founded in 1969, is also an "old man" in his sixties. The performance has been rising all the way. In 2019, the total revenue has reached 126.8 billion yuan, with a profit of 7.93 billion. In 2020, it will grow against the trend, with a revenue of 140.9 billion and a profit of 9.83 billion.

Helpless

The backgrounds of Changhong, Hisense, and Gree are quite similar. They are also well-known home appliance brands in the country, and shareholders also have local state-owned assets. The difference is that whether it is from the management of the company or the profitability of the product, Changhong and Hisense, Gree and other established electrical appliances companies are no longer at the same level of competition. In 2013 and 2014, Gree and Hisense have crossed the torrent of 100 billion in revenue and began to run all the way; also starting in 2014, the fortunes of the three companies have crossed, and it is difficult for Changhong. "Changhong", with a loss of nearly 2 billion in 2015, may face ST risks in 2016, and it is cruelly selling its real estate assets (Changhong Real Estate is doing well) to make a profit. History seems to be a joke with Changhong.

"For every three color TVs sold, one is Changhong"

Changhong's TVs can be regarded as military quality, which is obvious to all. This is related to the background of Changhong. Changhong's predecessor was a military industry enterprise. In 1958, the country began to convert military industry to civilian needs. Under this background, Changhong began to produce civilian home appliances. Many generations born in the 60s, 70s, and 80s still have a lot of affection for Changhong TV, and Changhong TV also accompanied them in their childhood. In the 1990s, Changhong won the first place in the Chinese TV industry. To what extent was the market share exaggerated that year? One out of every three TVs in the Chinese market belonged to Changhong. The market share is as high as 37%. Nowadays, the former "TV brother" has been "very old", with revenue of 88.793 billion yuan in 2019, which looks good, but it is a bit horrible to look at the profit when it is revealed: the net attributable to shareholders of listed companies The profit was 0.61 billion yuan, a year-on-year decrease of 81.3%. In 2020, profit will not increase, revenue will increase by 6.37% to 94.45 billion yuan, but only profit will be 0.45 billion yuan.

In terms of market share, according to IHS Markit's 2018 top ten TV brand ranking data, Skyworth, Xiaomi, and Hisense rank among the top three, all occupying more than 10% of the market share, while Changhong only occupies 7.4. % Of the market share was squeezed out of the top five.

Half of the profit on the book comes from government subsidies

The China Securities Journal disclosed relevant disclosures on Changhong's 2019 audit. In 2019, Changhong received a total of 278,096,500 yuan in government subsidies, accounting for 61.04% of the company's most recent audited net profit, which means that at least the most recent In more than a year, half of Changhong's book profits came from government subsidies.

Because high-tech companies have invested heavily in technology research and development in the early stage, receiving government subsidies can be regarded as recognition of their strength. This is not shameful, but over-reliance and even fraudulent behaviors are hard to see, and Changhong happens to be again. It's the latter.

Prior to this, Changhong even had "fraud" incidents. In 2015, Changhong received a notice from the local finance department in Mianyang (where Changhong headquarters is located) about returning nearly 440 million yuan in liquidation funds for the promotion of energy-saving home appliances (flat-panel TVs). . From the financial data released by Changhong, in 2015 and 2014, Changhong lost 1.68 billion yuan and 480 million yuan after deducting non-profits, respectively. In the past two years, they received subsidies of 260 million yuan and 240 million yuan respectively. . It can be seen that relying on government subsidies to increase profit figures is ultimately an unsustainable way.

At its peak, the market value of Sichuan Changhong reached 58 billion, and now it has fallen to 11.77 billion (as of April 30).

Gamble and stall

"Innovation has risks and costs," said Zhao Yong, chairman of Changhong, in an interview with Sichuan Economic Daily.

Looking back on the development of Changhong over the years, technological innovation but misjudgment of the route has dragged it into a deep pit, Zhao Zhangmen's sentence has profound meaning. In 2006, the color TV industry had a battle for the route of CRT, plasma, and LCD TV. In that year, the color, contrast, and dynamic range of plasma panels had obvious advantages compared with LCD, but its volume and power consumption were at a disadvantage. Changhong chose the investment direction. It is a plasma screen. The company invested 2 billion US dollars in the Korean Orion Plasma Company. Then, it invested 720 million yuan to establish Sichuan Hongou Display Device Co., Ltd. in 2007, which mainly produces plasma panels. However, in the fourth quarter of 2006, the LCD camp took the lead in achieving technological breakthroughs, leading plasma in size, power consumption, and cost by a large margin. Manufacturers such as Philips and Sony switched to the LCD camp.

Zhongyikang once provided a data. In 2004, the annual sales of domestic plasma TVs and LCD TVs were both 500,000-600,000 units, but the sales of LCD TVs have been increasing since then. By 2010, LCD TV sales had reached 34.51 million units, while plasma TV sales had only 1.61 million units.

Changhong added Hongou's investment. As of the end of 2013, the investment reached 1.72 billion yuan, but the result was consecutive losses. The financial data disclosed by Hongou shows that from December 31, 2011 to August 31, 2014, the company's assets and liabilities changed from RMB 4.954 billion and RMB 3.421 billion to RMB 3.992 billion and RMB 38. 8.9 billion yuan.

It is a pity that the market's balance is leaning towards liquid crystals. Changhong's gamble on plasma is ten years! Until 2014, Changhong sold 61.48% of the shares of Hongou Company for 64.2 million yuan. So far, Changhong has gambled on plasma screens. It ended in complete failure.

Is it a diversified layout or "not doing business properly"

Changhong's ambitions are great, but its strength is difficult to support its dreams. Its advantages in color TVs of its old bank have gradually weakened, and the development plans for other businesses are far from clear.

In advance of mobile phone brands, most people may only think of OV Huami and Apple. Many people still don’t know that Changhong is actually a veteran of the mobile phone industry.

Changhong entered the mobile phone industry as early as 2005. In that year, Xiaomi was still a kind of rice. I started to invite Miss Lin Chiling to endorse the mobile phone, but missed the outbreak of smartphones. Changhong did not eat the industry dividend. It was not until 2015 that it was later realized that in order to keep up with the popularity of the Internet of Things, it began to release its first 4G mobile phone. H1, the main concept of the Internet of Things, the Internet of Everything.

Liu Tibin, general manager of Changhong Company, held multiple conferences to express his confidence in the market, "Changhong mobile phone will definitely be able to seize the trend of the Internet of Things era, achieve a bottoming out, and regain the market", but this mobile phone did not arouse much Waves.

Perhaps it is also at an untimely time. Before the wind of the Internet of Things blows, Changhong will drift away by itself.

In 2017, Changhong launched the H2 mobile phone, which is different from daily consumer mobile phones and used for health and smart management. On the contrary, it is very "short-lived". This is not enough. The wind of the Internet of Things has just blown. In 2018, the concept of blockchain has come. Good guy, Changhong launched the R8 Kirin mobile phone and caught the concept of blockchain, but only one year, public information There are no traces of these mobile phones.

In June last year, Changhong disclosed a public official that was very eye-catching. The content was roughly about 589 acres of land resources of the company were injected into the project company Mianyang Shangcheng Real Estate Co., Ltd. (hereinafter referred to as "Shangcheng Real Estate"), and then publicly listed. Transfer 100% equity of Shangcheng Real Estate, valued at nearly 5 billion.

Good guy, Changhong Real Estate is not bad at playing!

In fact, as early as 2005, Changhong deployed real estate and quietly established its subsidiary, Changhong Real Estate Co., Ltd..In 2007, it continued to inject real estate and appointed Wu Youfu as the general manager, focusing on science and technology parks and R&D centers. Wu Zeng served as the former Vanke Beijing responsible. People, after taking office, did not take up the heavy responsibilities, and quickly conquered cities across the country. In 2008, it even became the three main business side by side with electronics and military industry.

The real estate business unit is regarded as one of Changhong’s “high-quality assets”. In the first half of 2016, its real estate business revenue was 432 million yuan, and its gross profit margin was as high as 29.01%. In contrast, the gross profit of its main home appliances The interest rate is only 15.83%. However, the proportion in the entire system is too small, accounting for 1.3% of its total revenue. When there is a sharp decline in performance, it often plays the role of "annual firefighting team".

For example, in September 2016, Changhong's 9th Board of Directors reviewed and approved the "Proposal on the Company's Transfer of Shanghai Changhong Building": "In order to further improve the company's asset utilization efficiency, save management costs, and revitalize existing assets, it agreed to the company's public transfer of Shanghai Changhong Tower. building".

Early Bird Information learned that until the end of 2018, in order to "save" the financial report, this building was finally sold. However, the market value of 150 million was sold for 81 million, and the actual income had shrunk by nearly half.

Seemingly familiar with Yan's return

Sichuan Changhong once stated in the 2018 semi-annual report: "The company will accelerate the pace of industrial optimization and decisively stop bleeding and stop losses.". After this financial report was issued, the secretary of the board of directors also stated that the company's main business is still home appliances.

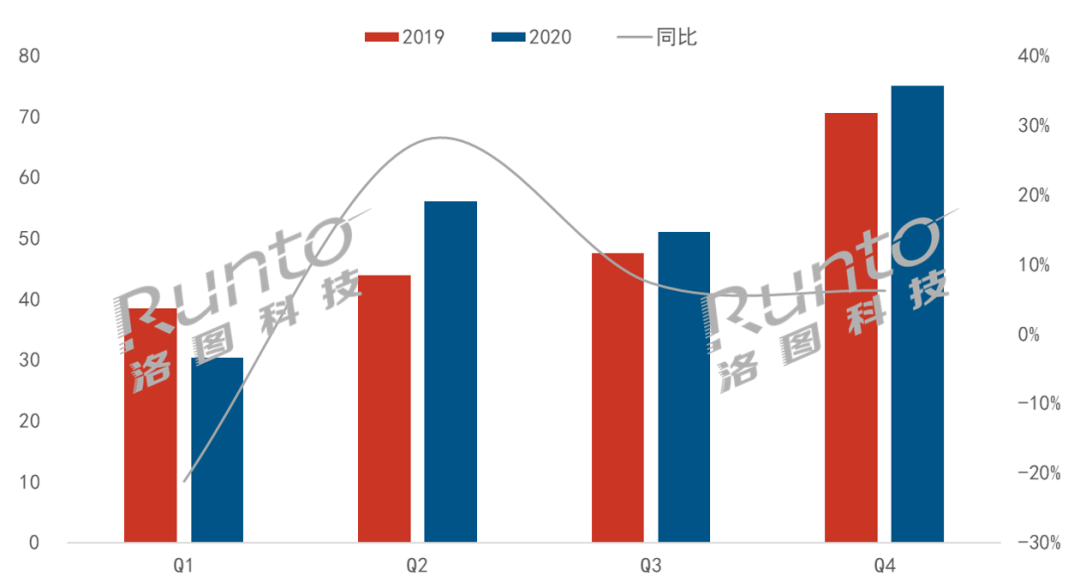

According to the "Report on China's Home Appliances Market in 2020", in 2020, affected by the new crown pneumonia epidemic and the price increase of LCD panels, the total market of the color TV industry has declined, and the overall market retail sales for the year was 128.8 billion yuan, a year-on-year decrease of 15.7% . However, laser TVs are an "alternative". According to the "Quarterly Report on Laser Projection Market Analysis in Mainland China" released by Luotu Technology, the laser TV market in China will ship more than 212,000 units in 2020, a year-on-year increase of 5.9%. .

Combined with the 2020 financial report of Changhong, it can also be found that it has invested a lot in laser display lenses, micro-structured projection screens, three-color laser light machines and industrialization, and has gained a lot, ranking third in China's market share. In the color TV market, Changhong may choose laser display in the home appliance segment as its new growth engine.

From the perspective of the general environment, the national policy also attaches great importance to the development of the laser display industry. The "13th Five-Year Plan" lists laser display as the first new display project for new generation information technology. At the same time, the shortage of LCD screens and rising prices have a huge impact on mid- and downstream brands.

According to Zhongyikang's data, from 2014 to 2019, the compound annual growth rate of laser TV reached 281%, and the sales in 2022 are expected to exceed 10 billion yuan. Compared with the growth of other color TVs in the same period, laser TV can be described as a high-speed train.

In 2018, Changhong launched the world's first three-color 4K laser TV and Fresnel optical sound screen, which were the first to achieve first-class energy efficiency; in 2019, the three major laser TV brands of Changhong, Hisense and PPTV joined hands with Suning to launch the "2019 Laser TV Living Room Renewal Action". Announced a strategic cooperation and signed an on-site sales order for 100,000 units of Suning channels for the whole year of 2019.

"Laser TV has differentiated usage scenarios, which can meet the needs of home-level and cinema-level consumers, and will coexist with LCD TVs for a long time in the future." Dong Min, vice president of Ovi Cloud, believes that Hisense has taken the lead in laser TV. Daqi and Changhong may be able to take the lead in the new round of display industry competition.

Nowadays, with the forward drive of 5G large bandwidth and the upgrading of 8K ultra-high-definition images, the TV industry is eager to test its multiple technical routes, and a broader application market is opening up. I am looking forward to Changhong's focus on its main business and a beautiful scene. The turn of events.