This article is written based on public information and is only used for information exchange and does not constitute any investment advice.

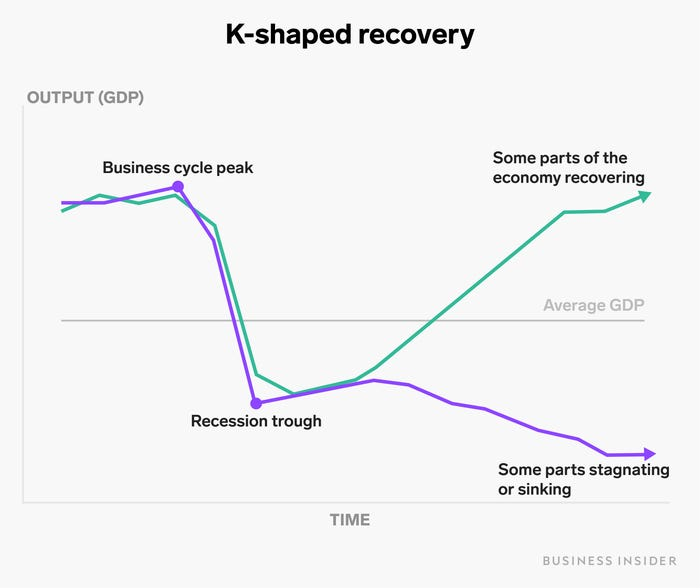

At this time a year ago, JP Morgan Chase put forward the famous K-shaped recovery theory in a research report called "The shape of the recovery".

This theory believes that as the impact of the epidemic is fully exposed, the economy as a whole enters a recession, but soon, some economic activities have achieved a rapid recovery - including online meetings, home building materials, medical equipment, financial investment needs, and even far ahead of the epidemic. Over the same period; while some other economic activities, such as overseas tourism and service industries, were completely suppressed during the epidemic, and they have been unable to return to normal.

Economists at JPMorgan Chase therefore gave the definition of a K-shaped recovery:

The economy as a whole showed an uneven recovery. Some economies have been slow to recover, while others have significantly overheated, which widened the gap between the two sides. For those businesses that have been unable to return to normal, their valuations continue to fall; and those businesses that have undergone tremendous changes enjoy higher valuations.

Following the K-type recovery model, focusing on Haier Smart Home (SH:600690), Midea Group (SZ:000333) and Gree Electric (SZ:000651), the cold and warmth were fully revealed.

01

"K-shaped recovery" in the quarterly report

In the market situation of the past year, the specific trends of the Big Three have clearly diverged. The one who is in the leading position is the Haier Zhijia who took the lead out of the haze of the epidemic.

Behind the good performance of Haier Zhijia's market value is the choice of institutional investors to vote with their feet:

In the 2021 quarterly report, Haier Zhijia’s fund holding ratio has reached 10.41%. In the past five years, Haier Zhijia’s fund holdings have continuously increased from 3% to 10%; and Haier Zhijia is optimistic. The number of funders also rose from 163 to 1,095. More and more organizations are beginning to recognize the changes of Haier Zhijia in the past five years.

The number of fund holders and the proportion of equity holdings have increased for 5 consecutive years. Source: Choice

To be able to make such a choice in a generally stable industrial structure, the market is foreseeable: for the first quarterly report of Haier Zhijia, which has the most extensive and in-depth overseas layout, the market has given higher expectations and is more recognized. Its long-term investment value.

Regardless of the impact of the 2020 epidemic, Haier Zhijia showed strong growth capabilities in its first quarterly report: operating income in the first quarter was 54.77 billion yuan. After excluding the factors affecting the scope of consolidation, it increased by 24.4% compared to 2019Q1. This ultra-high growth rate dwarfs the other two giants: In the first quarter, Midea Group's revenue increased by 10% compared with 2019, while Gree's first-quarter revenue even fell by 18% compared with 2019.

The comparison of profitability is even more stark: Haier Zhijia achieved a net profit of 2.82 billion yuan in the first quarter, an increase of 199.3% year-on-year, and an increase of 49.6% compared to 2019Q1.

You know, these are all based on the background that commodity prices have risen sharply in the first quarter and the profit margins of downstream manufacturing have been sharply compressed. The data shows that Haier Zhijia has not only taken the lead out of the impact of the epidemic in terms of performance, but also fully interprets the K-shaped recovery, successfully digesting the unfavorable factors of rising commodity prices.

02

What did the market see?

Frankly speaking, today's result comes from the market's anticipation many years in advance for the future.

In the rules of the game for analysts and fund managers, in the past few years, Haier Zhijia has quietly changed, and some numbers have long hinted at the second growth curve logic of Haier Zhijia:

First of all, Haier Zhijia's R&D investment in Casarte and air conditioners is receiving returns.

Unlike the other two giants whose R&D investment is close to the peak, Haier Zhijia’s R&D investment is still increasing rapidly.

In the 2020 annual report, Haier Zhijia’s R&D expenditure increased by nearly 7.6% year-on-year.

From the perspective of the R&D investment of the three companies, the rapid growth in R&D and the rapid increase in absolute value of Haier Zhijia are the core driving forces for Haier Zhijia to support Casarte's continuous innovation.

According to data from Zhongyikang, in the 4th week of 2021, TOP10 air-conditioning brands have a total of 18 new products. Among them, Haier air-conditioning contributes 8 new products, and the contribution rate of new products ranks first. At the same time, the healthy air track pioneered by Haier Air-Conditioning has also injected vitality into the value war of industry transformation.

According to the quarterly report, Haier Zhijia's high-end brand Casarte achieved a revenue growth of 80%, and its revenue share has further increased. The share of high-end products absolutely leads the market. According to data from Zhongyikang, the share of refrigerators with more than 15,000 yuan reached 43%; The share of washing machines above RMB 10,000 was 78.1%; the share of air conditioners above RMB 15,000 reached 22.3%, and the long-term value of high-end brands continued to be released.

Secondly, Haier Zhijia’s strategy of going overseas to create a brand has also entered a period of comprehensive harvest.

Due to the full peak of market penetration, in the past five years, the entire industry has rapidly involved, with constant price wars internally, and foreign exchange through OEMs. In sharp contrast, Haier Zhijia's strategy of going overseas for independent brand creation that has been laid out for more than 20 years is entering a period of full harvest:

During the reporting period, Haier Zhijia’s overseas revenue increased by 24.6% year-on-year, and its high-end product revenue increased by more than 40%. After nearly 10 years of operation, Haier Zhijia has realized the pattern of splitting overseas and domestic revenue for the first time in 2020.

On the one hand, Haier Zhijia’s seven independent brands have been coordinated globally, and domestic and foreign high-end brand operations have been completed. The high-end brands Café and GEProfile have continued to increase their share in the United States. .

On the other hand, the company is deeply engaged in localized marketing, and expands its global sales network with the help of KOL, multi-platform short video operation, cloud crowd broadcasting and other methods. During the reporting period, the company's entire network fans increased by 20% year-on-year to 12 million. The online business in the South Asian market grew rapidly, and the number of fans in the Southeast Asian market increased exponentially.

Finally, in the past year, Haier Zhijia completed the "breaking circle" of the traditional home appliance industry.

While other companies are still at the stage of producing and selling a single series of products, Haier Zhijia has completed the extension from the product to the scene by creating the scene brand "Triwing Bird", thereby achieving a non-linear leap in customer acquisition efficiency and value.

During the reporting period, Haier Zhijia APP's daily activity increased by 584% year-on-year, and monthly activity increased by 1484% year-on-year; network appliance sales increased by 59% year-on-year, and network appliance binding volume increased by 151% year-on-year.

At the same time, in terms of ecological brands, Haier Smart Home actively promotes the construction of the Internet of Food and the Internet of Clothing. Process healthy eating experience, launch "New Year's Eve Dinner" package during the Spring Festival, retail 15,000 sets, 120,000 dishes.

To be fair, the financial report of Haier Zhijia shows not only the increase in profits and revenue, but more importantly, the changes that Haier Zhijia has accumulated over the years. Changes in pricing are reflected.

03

Conclusion: The due reward of the forerunner

Forerunners are always not understood: when Haier Zhijia went overseas to create a brand more than 20 years ago, there were few followers. Today, Haier Zhijia has completed the layout of brands, channels, and supply chains overseas, and the space for overseas profit margin improvement is gradually opening up. This is the core logic of the high valuation given by the market.

After establishing the scale effect from a global perspective, Haier Zhijia once again took the lead in the industry 15 years ago, with Casarte as the center of the army, and fully promoted the high-end products and brands. Since then, with the gradual maturity of the Internet of Things technology, the global consumer-oriented scene brand "Triwing Bird" took advantage of the trend, making Haier Zhijia once again stand on the commanding heights of users' minds and industrial potential. Under the superposition of the three waves, Haier Zhijia has completed the self-innovation of traditional business to intelligent ecology, which is the core grasp of its future growth logic.

Perhaps, to outsiders, Haier Zhijia’s market value performance today seems to be a surprise, but judging from the performance of this financial report a year after the epidemic, the clues to Haier Zhijia’s K-shaped recovery have long been buried in the efforts of many years ago. middle.