Recently, Skyworth Group can be described as a hot spot.

On April 27, Skyworth TV was accused of illegally obtaining user information and went to the news; on the same day, Skyworth Group car building rumors were rampant; that night, Skyworth Group announced its 2021Q1 performance report.

A series of hotspots have also made the market pay more attention to the financial report of Skyworth Group. Let's first look at the core data performance of this:

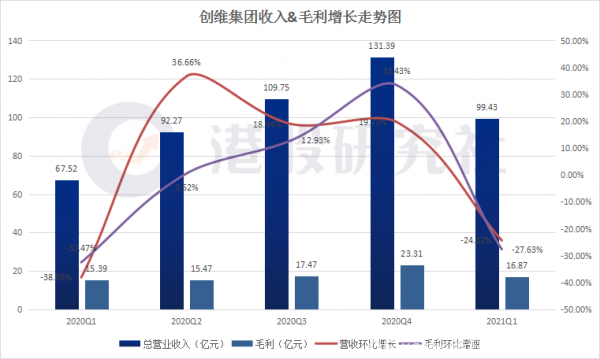

The financial report shows that during the period, Skyworth achieved a turnover of 9.943 billion yuan, a year-on-year increase of 47.3%; a gross profit of 1.687 billion yuan, an increase of 9.61% compared to last year's 1.539 billion yuan; a net profit of 1. 700 million yuan, down 16.3% year-on-year.

The day after the financial report was announced, Skyworth Group's stock was suspended and opened lower, with a closing price of HK$2.59, a decrease of 1.89%. In the previous five days, Skyworth Group’s stock price has been rising, which shows that the market is not optimistic about this performance report.

As one of the top brands in the field of home appliances, Skyworth Group has mixed good and bad news. From the perspective of revenue and profit, Skyworth has got rid of the negative growth trend of last year's epidemic and returned to the level of 2019 in one fell swoop. However, from the perspective of the realization of the stock market, the market is not optimistic about the current financial report of Skyworth Group.

What happened to Skyworth Group that allowed a financial report to guide the stock market?

Industry recovery drives revenue growth, but high raw material costs have become a profit constraint

According to financial report data, Skyworth Group realized revenue of 9.943 billion yuan in 2021Q1, a year-on-year increase of 47.3%, and the growth rate turned from negative to positive last year.

In terms of specific domestic and foreign business, its revenue in the mainland market was 6.247 billion, a year-on-year increase of 42.7%, and the revenue contribution rate was 62.8%; overseas market (including Asia, Europe and the Middle East) revenue was 36.96 100 million yuan, an increase of 55.6% year-on-year, and the revenue contribution rate was 37.2%. In terms of revenue alone, Skyworth Group handed in a pretty good answer.

This is mainly due to the expansion of overseas markets and the rapid growth of overseas revenue growth, which drives the overall revenue. However, it is worth noting that compared with the 38.69% revenue contribution in 2020, the overseas market is not as strong as the market imagined in 2021Q1. This is partly due to the fact that overseas is still in the epidemic and it is difficult to expand the market.

On the other hand, the rapid growth of revenue is mainly due to the recovery of demand in the home appliance industry. According to public data, the market size of the home appliance industry in the past Q1 quarter was 153.9 billion yuan, an increase of 45.6% year-on-year in 2020. .

At the profit level, although the gross profit achieved in 2021Q1 was 1.687 billion yuan, an increase of 9.61% compared to the 1.539 billion yuan in the same period last year, the gross profit margin fell by 580 basis points to 17%, and the net profit fell 16% compared with the same period last year. .3%.

It can be found that the growth of Skyworth Group's revenue and profit in this quarter has clearly diverged. When the revenue growth rate reached 47.3%, the gross profit growth rate was only 9.61%, and compared with the gross profit of 1.721 billion yuan in 2019, the gross profit growth rate of Skyworth Group is still negative.

Under the global epidemic, the demand for electronic products has increased, which has led to a shortage of global chip supply. This situation has spread to the home appliance industry at the beginning of the year; at the same time, the global epidemic has also caused the cost of home appliance raw materials to rise, resulting in many Small home appliance companies have stopped production. Under the butterfly effect, the price of flat-panel TVs has risen by more than 10% this year, and the price increase may continue until the third quarter of this year.

But different from this market situation is that some major appliance companies rely on their own channels and cost control capabilities, and their home appliances have not increased prices. Among them, the representative of home appliances, Gree, said that they will not consider price increases for the time being. The reason behind this is the tacit price war in the home appliance market.

Therefore, in the fiercely competitive home appliance market, Skyworth and other leading companies will not risk losing market share and increase prices. This has led to a lack of gross profit growth when revenue growth reaches 47.3%. Break the single digits.

In fact, as early as 2020, the smoke caused by such price wars will be shown in the form of annual reports. According to Sichuan Changhong's 2020 annual report, there has been a phenomenon of increasing revenue but not profit.

What home appliance companies need to pay attention to is that the rising cost of raw materials and the lack of cores will undoubtedly worsen the situation of home appliance companies that are in a price war, and may squeeze their subsequent profit growth.