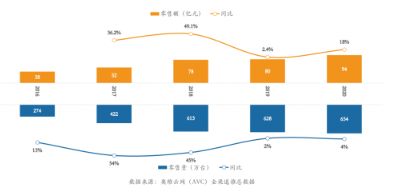

In recent years, with the upgrading of quality consumption of home appliances and the popularization and development of intelligent technology, the growth rate of the intelligent sweeping robot industry has been far exceeding that of other home appliances categories. According to AVC's total data, from 2016 to 2018, the compound annual growth rate of the retail sales of smart sweeping robots was 38.7%; in Q1 of 2019, although the growth rate of the vacuum cleaner industry slowed down, smart sweeping Robots are under pressure to achieve a good result of a year-on-year increase of 20.0% in retail sales. According to data from Zhongyikang, the sales of intelligent sweeping robots increased by 19.1% in 2020, of which online sales increased by 6.5% year-on-year, and sales increased by 24.1% year-on-year.

In this regard, some professionals analyzed, "Being able to achieve such a growth rate, in addition to being catalyzed by the epidemic, people generally spend longer at home, and pay more attention to household hygiene, cleaning and disinfection, but also inseparable from the upgrading of technology." From the earliest random cleaning and gyroscope positioning correction to today's planned cleaning of LDS laser ranging navigation combined with SLAM algorithm, the cleaning performance of the product is continuously optimized, and the content of manual intervention is continuously reduced, providing consumers with better Experience.

At this stage, comparing the types of smart sweeping robot players that have entered the game, it can be found that there are mainly professional R&D companies, Internet companies, traditional home appliance companies, technology-based cross-border companies and many other camps. From the initial three or five players, it has now expanded to 200 Brands. As far as the current competitive landscape of intelligent sweeping robots is concerned, Cobos relied on its first-mover advantage. Stone and Xiaomi have become the top three in the industry, while Yunjing and Yuri have also quickly reached the top by virtue of their own strengths, successfully ranking among the top 5 brands in the industry. According to data from Ovi Cloud Network in February 2021, the intelligent sweeping robot brands led by Cobos, Yunjing, Xiaomi, Stone, and Yuli have market share of 42.66%, 13.42%, and 10. 1%, 9.08%, 6.92%.

Data source: Ovi Data

From the perspective of product layout, the current intelligent sweeping robot products are being upgraded and developed in the direction of intelligence and high-end. The major brands have established their core competitive advantages mainly around the navigation system and cleaning system.

In terms of navigation technology, inertial navigation systems in the past are gradually being eliminated by the market, and the mainstream technologies in the market are laser navigation and visual navigation. The former has relatively mature technology and high reliability, but its disadvantages are inaccurate positioning and limited detection range of lidar; the latter compensates for the disadvantages of laser navigation in the detection range, but its own disadvantage is that it cannot work in dark places. Cobos and Rock's solution is to share lidar and AI vision sensors, which improves the obstacle avoidance ability of intelligent sweeping robots to a certain extent.

In terms of cleaning systems, in response to the ever-changing new needs of consumers, the intelligent sweeping robot has undergone technical iterations in different stages from single-sided brushing, bilateral brushing, integrated suction and mopping, dust box-free cleaning, and mop self-cleaning. The gap between the first three companies is not too big, which shows that their technical barriers are not high. Among the latter two types of intelligent sweeping robot products, Yuri's automatic dust collection intelligent sweeping robot V980 Plus and Yunjing's intelligent sweeping robot "Little Beluga" which can automatically wash mops can be described as typical technical representatives in the industry, which greatly improves users. The convenience and intelligence of use allow consumers to truly free their hands.

Based on the above market performance, Yuri is a new brand that has entered the market (China) for less than four years. The reason: On the one hand, Yuli is well versed in product design and adhering to "ingenuity" research and development, and has accumulated deep technical background and successful experience in product manufacturing; on the other hand, Yuli follows the trend in the publicity channel-with the help of online communication The new channel not only reached a strategic cooperation with Tmall International, but also promoted the product on social platforms such as Xiaohongshu, Douyin, and Kuaishou. At the same time, it also conveyed to consumers that “not only liberate hands, but also exquisite The concept of "life" has given the brand a good reputation.

From the perspective of the changes in the proportions of different price segments in the smart sweeping robot market from 2016 to 2019, in the online market, although models below 2,000 yuan are the main lineup, compared to the total sales of 83.14% in 2016, in 2019 Its sales accounted for a total of 63.48%, a continuous decline of nearly 20%. At the same time, models above 2,000 yuan have shown a good growth trend, and in 2019, models in the price range of 2,500-2999 yuan have the fastest growth, and their proportion has increased by 10.34% compared with 2018. Online market The mid-to-high-end development has accelerated significantly.

However, according to the "2021 Smart Sweeping Robot Market Development White Paper", although mainstream brand products have reached a high level in all aspects, there are still a large number of products using outdated technologies in the market, and the products are mixed. In addition, users have insufficient awareness of the product. If they accidentally purchase products with unsatisfactory functions and performance, these consumers will label the smart sweeping robot products as "pseudo-intelligence" and "not practical". To a certain extent, it has delayed the popularization of intelligent sweeping robots in the domestic market.

Therefore, some people in the industry said that mainstream brands in the market should assume social responsibility, use more "good money" to accelerate the elimination of inferior products, and maintain a good development environment for the industry; in addition, in the future, intelligent sweeping robots should be able to "Using" becomes "easy to use" and meeting consumers' real-scene needs is a question that the industry and brands should continue to think about.